We are seeing more and more professional services firms – and their clients being investigated by HMRC for tax evasion. HMRC issued 1,414 production orders to accountancy, law and other professional services firms in relation to investigations into tax evasion according to this report by economia.

At least two Manchester United stars were reported to have been investigated by HMRC over alleged image rights tax evasion as the authorities opened new cases against top footballers in the Premier League.

As enquiries escalate amongst top flight footballers, tax investigations into the affairs of small business are also on the increase and we say it is because both groups are easy targets for HMRC.

Are you under investigation by HMRC?

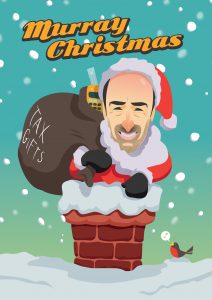

Murray Patt, founder of Manchester-based accountants Alexander Knight & Co, said:

“It increasingly feels as if small and medium-sized businesses and Premier League footballers are two of the most targeted groups for tax investigations by HMRC.

“In the case of footballers, forming an image rights company to receive payments of up to one fifth of a player’s salary is actually a legitimate tax strategy approved by the authorities if set up appropriately.

“However, it’s logical for the authorities to launch investigations into high profile players who earn their wealth via multiple sources because it can be a rich source of extra income, particularly for players who are new to the Premier League from other countries where tax rules are different.

Get insurance for HMRC investigations

“Let’s not forget that small and medium sized businesses are an even easier target. If you don’t take care as a small business owner you’re at risk of being pulled up over minor mistakes or small disparities, which could incur disproportionately heavy fines and penalties imposed by HMRC.

“It’s important to have insurance in place to cover the cost of an investigation if you are a small or medium sized business, since in most cases you won’t have the funds of a top-flight footballer. Don’t get caught offside by HMRC.”