Download our guide to Budget 2024 here.

Our practice in Hale, Cheshire is expanding. If you are an experienced tax professional and you’d like to join our team – or you know someone suitable – please send a confidential email to Alison Spier in the first instance.

We have an exceptional list of loyal clients with multi-million turnover businesses. The majority of these companies have been working with us for many years and we are highly focused on building long term, meaningful relationships.

We are growing our team and have created this new Tax Senior Manager role. Part-time will also be considered for the right candidate.

Suitable candidates will have experience working in a fast-paced accountancy practice, dealing with clients both face to face and over the phone, advising them on a variety of tax issues, including corporation tax, including R&D, & CGT. You must be able to demonstrate exceptional client relationship skills, and have an approachable, professional manner. Experience with income tax, IHT & SDLT would also be extremely useful.

As part of MGI Worldwide, the global accounting network, you will also join the Tax Forum, enabling you to network with peers from other practices across the UK and worldwide. International tax conferences are also organised by MGI Worldwide and you will join delegations to these when they occur.

If you feel that your experience is a good fit and you are looking for a modern accountancy practice – based in Grade A offices in the heart of Hale – to develop your career, and you would like to find out more, please email Alison Spier with your updated CV and details of your current package.

Disclaimer

Alexander Knight & Co is an equal opportunities employer and no terminology in this advert is intended to discriminate on the grounds of a person’s gender, marital status, race, religion, colour, age, disability or sexual orientation.

All candidates will only be assessed in accordance with their merits, qualifications and abilities to perform the role expected. Only successful applicants will be invited to the next stage consisting of an interview and assessment.

Are you a commuter passing through Altrincham rail station? Keep an eye out for the latest Alexander Knight & Co advertisement proudly displayed on the information board!

We understand the importance of clear, concise information—whether it’s about your financial and business goals or your train schedule. That’s why we’ve sponsored this information board in our home town of Altrincham.

Murray Patt, founder of Alexander Knight & Co said:

“We’re proud to feature at Altrincham Rail station. We deliberately selected Platform 4 because this is the stop for the historic Mid Cheshire line which takes in Manchester, Chester, Stockport and Hale where our office is located.”

The advert at Altrincham Rail Station in 2024:

Alexander Knight & Co is delighted to have been appointed by Clancy Consulting to provide audit and accountancy services.

With roots going all the way back to 1972, Clancy has been delivering industry leading engineering for more than fifty years. Founded by Brian Clancy in South Manchester, the business started out life trading as The Brian Clancy Partnership.

Initially focused on providing civil and structural engineering services in the North West, the Clancy of today has evolved to include 10 offices across the UK. Clancy has also developed international links and has expanded globally by partnering with local firms in India and Oman.

Clancy’s multidisciplinary engineering services, national expertise and local knowledge are renowned amongst its broad client base, evidenced by the many clients who have retained their services for multiple decades.

Murray Patt, founder of Alexander Knight & Co, said:

“Clancy Consulting is a forward-thinking practice and a leader in the field. We are delighted to have been appointed by this dynamic and growing organisation and we are looking forward to developing a positive relationship.”

You can find out more about Clancy Consulting here.

Payroll Manager (Part-time) Hale

We are now recruiting for a Payroll Manager to join us on a part-time basis.

The role is two days per week based in our office in Hale, Cheshire and previous experience in payroll is essential.

Alexander Knight & Co is based in Grade A offices at Westgate House on Hale Road and we are an award-winning accountancy practice. We work with clients across the region and beyond.

Duties

- Preparing monthly payroll for clients

- Making relevant submissions to HMRC

- Processing payroll payments and make relevant payments to HMRC.

- Auto enrolment and submission of pension information on behalf of clients

- Liaising with clients to answer payroll queries and deliver excellent service.

- Carrying out year end activities such as producing P60s, claiming Employment Allowance and completing P11d’s where necessary.

To apply please email Alison Spier with your CV alison@alexanderknightaccountants.co.uk

After more than a decade of designing bespoke cards, printing and posting – this year, we have decided to make a donation to charity instead.

Crisis at Christmas is an annual Christmas appeal that helps provide warm meals, shelter, support and companionship to those experiencing homelessness. We have made a donation to support Crisis in continuing its good work.

We wish all our clients, staff and professional associates a ‘Murray Christmas’ and a Happy New Year.

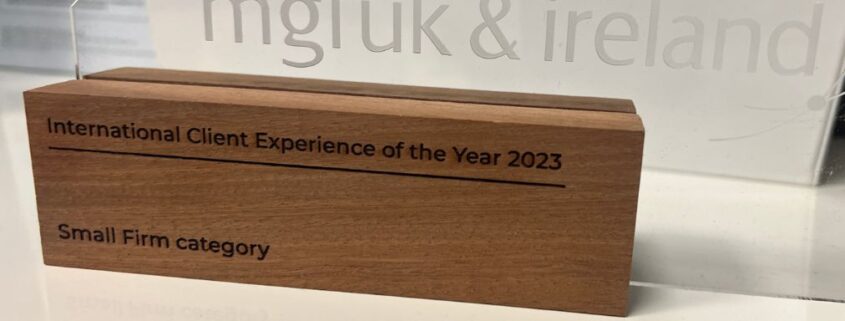

We were delighted to win an award based on our successful accountancy work for international-based clients who have operations in the UK.

At the 2023 MGI UK & Ireland conference for partners & managers, which was held recently in Edinburgh, Murray and Kate collected the award on behalf of Alexander Knight & Co for ‘International Client Experience of the Year 2023’.

We became a member of the MGI Worldwide in 2020. Member firms, which comprise 8,500 professionals operate in more than 100 countries.

Joining the network has bolstered our international trade links and has enabled us to collaborate with accountancy firms in other jurisdictions.

Multiple companies headquartered in Canada, USA, Germany, Holland, Greece, Denmark, Switzerland, Malaysia and Singapore have appointed our team to support them with a number of specialist services that we provide including Audit, Tax and Advisor.

Murray Patt, founder of Alexander Knight & Co, said:

“We are pleased to have developed our international links and delighted to have won this award. It’s great recognition for our staff who are providing a fantastic service for our clients headquartered in the UK and aboard.”

We are delighted to extend a warm welcome to Greg Monk who joins our Audit & Accounts team based in Hale. Greg studied Maths & Finance at the University of Liverpool and has now joined our growing team.

Welcome to the team Greg!

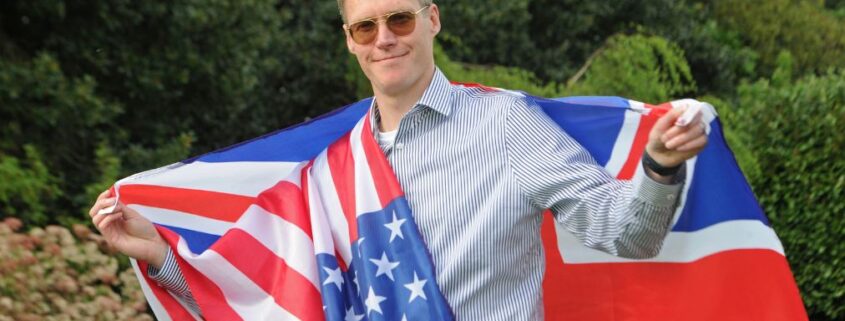

We were delighted to catch up with the team at GaraDry, an innovative product design company, which won a prestigious King’s Award for Enterprise earlier this year.

GaraDry designs, manufactures, and sells the world’s largest range of threshold seals for residential garage doors and commercial doors.

We caught up with founder Ashley Smith who was happy to share some of his key experiences in cracking open the giant American marketplace…

“We launched our USA subsidiary in the USA in 2017 (GaraDry LLC), to handle strong interest from Americans in our products and we also launched a fulfilment centre in Tennessee to ship transatlantic orders quickly.

“People shouldn’t be frightened of exporting to the USA. My view, as an online retailer is that it should be as easy to sell your goods in Baltimore as it is in Blackpool if you have the right infrastructure, processes and people on your team.

“The impact of fluctuating exchange rates can make a huge difference to the viability of your export model. As well as margins being heavily dependent on these fluctuations, you’ve also got inflation to contend with on both sides of the pond.

“Shipping costs have stabilised recently but there was a time last year when the cost of a container to the States tripled in the space of just a few short months. The volume of containers to the USA reduced, putting up prices for everyone. You need to be very prepared for these kinds of issues which are largely out of your control.

“Overall, business is very good for us in the USA, The American public has taken to our products very well and we have a brilliant relationship with our customers in the USA.

“We see the USA as a key market for our range of products and we are constantly evolving our sales and marketing processes to generate more sales right across the USA.

“We’re really pleased we’ve got Alexander Knight & Co as our accountants and having the right professional advisers on board makes a huge difference to our success.”

Murray Patt, founder of Alexander Knight & Co, added:

“There is huge demand for the GaraDry range of garage seals in the USA and we are delighted to be their accountants and support them in their growth journey in the USA.

“As part of our membership of MGI, the global accounting network, we have first class contacts across the USA and can make introductions to the right people who can assist on the ground if you want to export to the States.”

Alexander Knight & Co is proud to support Junior Stage 80’s production at Sale Waterside in November. This year’s magical offering is the incredible Rodgers & Hammerstein musical production of Cinderella. It’s a brilliant opportunity to immerse yourself in this timeless story of love and hope.

Tickets are on sale here.

As part of our tradition of supporting the arts we are delighted to be associated with such an iconic and cherished production.

Alison Spier, head of marketing at Alexander Knight & Co, said:

“We are always pleased to support productions by Junior Stage 80. We wish all of those involved – front of stage and backstage – the best of luck and we are sure that this show will be a huge success.”

GET YOUR TICKETS FOR CINDERELLA AT SALE WATERSIDE HERE.

Latest News

Murray Christmas 2025!December 7, 2025 - 8:23 pm

Murray Christmas 2025!December 7, 2025 - 8:23 pm Budget at a Glance 2025November 26, 2025 - 9:52 pm

Budget at a Glance 2025November 26, 2025 - 9:52 pm Special commemorative baton passes through Altrincham and Hale as part of Railway 200 celebrationsSeptember 25, 2025 - 11:29 am

Special commemorative baton passes through Altrincham and Hale as part of Railway 200 celebrationsSeptember 25, 2025 - 11:29 am