|

|

|

|

|

|

Many people have used the opportunity of lockdown or redundancy to start a new business during the past few months.

If you’re thinking of setting up a business, you’ll probably be looking forward to doing things your way without pressure from managers and directors trying to get you to do things which make no sense.

Being in charge of your own destiny – even in these challenging times – can be thrilling and rewarding for people with an entrepreneurial mindset and the right accountant.

Rushing into starting a new business can be tempting – it can’t be that hard, can it? Yes, of course it is possible to start straight away with no planning or thought – however, the most successful businesses are those that have considered the detail of what they need to set-up.

That’s where we come in. After all, we were a start-up once! That means we understand what you’re going through.

Once you’ve decided on the finance you need and the premises you’ll be working from it’s a good idea to think about business structure.

Predominantly, business owners tend to set themselves up as a sole trader or limited company. It’s important you make this decision with our help as it can affect your take home pay after tax.

Our team will assist you with:

Demand for electric cars amongst our business owner client base continues to rise as prices fall. This drop in price on lease deals and RRPs for electric cars coupled with tax breaks means many company directors are going electric.

Company car owners paid a zero benefit-in-kind on certain fully-electric vehicles in 2020-21, compared to as much as 37 percent on vehicles with high CO2 emissions. For the tax year 2021-22 the benefit-in-kind on fully electric vehicles will be just 1% (of the vehicle’s list price, with accessories).

As a result of this premium electric vehicles could save business owners £1000s – compared to traditional vehicles.

You can download our free company car tax guide here to see how much you can save.

The launch of luxury models such as the Mercedes-Benz EQC, Audi E-Tron, together with Porsche and Range Rover hybrid vehicles follow the success of the Tesla Model 3 which is already considered to be a cult company car for British sales executives

Company cars have been deeply unfashionable for more than a decade now. In that time, most business owners have understood that they were better off buying a car personally and then claiming the associated expenses.

One client of ours saw more than £10,000 knocked off his tax bill because he plumped for the Range Rover hybrid model over the diesel version.

With more e-charging points being installed across the country, improvements to the range of electric engines and a steady fall in the price we are predicting a renaissance of the company car.

If you need advice on the most tax efficient way to procure an electric car speak to our tax team on 0161 980 8788.

As it stands, the Government has given no indication the furlough scheme will continue beyond October.

The scheme has already been extended twice, once to June, then again into October.

The scheme itself is tapering off and many employers will have important decisions to make on their future staffing needs beyond October.

It is worth a reminder that the Government is launching a job retention bonus of £1,000 (per employee) for employers willing to bring back furloughed employees back into work, in what they hope is an incentive for firms to retain staff beyond January 2021. We don’t yet know how the monies will be claimed but we will inform clients when the details are published.

All our clients who made furlough claims via our team secured the funding on time and we’ve been pleased to help our clients through what can be a complex process of calculation for the uninitiated.

If you need support to review your business plan or staffing levels when the furlough scheme ends then please speak to our team.

The clock is ticking for businesses that wish to apply for support via the Coronavirus Business Interruption Loan Scheme. Applications need to be submitted by midnight on September 30th . Any business who meets the criteria has until then to complete the application process.

We should add that this deadline also applies to the “little brother scheme” known as the bounce-back loan scheme. Under this scheme the maximum available to borrow is the lower of £50k or 25% of your annual turnover.

The scheme helps small and medium-sized businesses to access loans and other kinds of finance up to £5 million.

A panel of approved lenders (which includes all the mainstream commercial banks) can provide up to £5 million in the form of loans, overdrafts, invoice finance and asset finance.

The government guarantees 80% of the finance to the lender and pays interest and any fees for the first 12 months.

Our administration of all the Government support schemes applications on behalf of our clients has been 100% successful.

We have secured funds rapidly for them to inject into their business at the extremely attractive terms offered under the CBILS packages (and the bounce back loan scheme).

If you need support in completing your application for this scheme before the deadline on September 30th – please email Murray Patt as soon as possible.

Since lockdown began, we’ve noticed a significant upturn in the number of business owners who live just a ‘stone’s throw’ from our office in Hale expressing how much they love having their accountants based near where they live.

A large number of business owners (and their advisers) choose to live in Hale, Hale Barns, Bowdon or Altrincham – even if they run successful businesses in other parts of Greater Manchester.

Many business owners have already confirmed that that they have no intention of their staff returning to work as normal in their city centre office – and neither do they.

In fact, like us, they swiftly adapted to the new normal and have been able to continue their business operations with the vast majority of staff working at home thanks to technology and an entrepreneurial attitude.

Being located in Hale means we are perfectly placed to deliver our professional services to business owners who, in no uncertain terms, want to avoid Manchester city centre!

By appointing us as your accountants you’ll avoid all the headaches that come with trips to the city centre including: the commute into town, parking problems and the sheer waste of time and unproductiveness of meeting accountants in the city centre.

We have:

Of course, we’re always ready to meet via Zoom – but we firmly believe that most people in business still prefer a face-to-face meeting – and there’s nowhere handier for locally-living entrepreneurs than our office in Hale.

We were looking for a budget to support businesses – jobs – and help entrepreneurs during unprecedented times.

Today’s statement by the Chancellor goes some way towards that goal – but we will be analysing the details over the next few days and weeks to see how it impacts our clients who are running businesses in the real world where existing conditions remain challenging.

Key highlights:

£1,000 Job Retention Bonus

If you have furloughed staff – and you bring them back into the workforce through to January, you’ll be entitled to £1,000 per employee. This is badged as an ‘incentive’ for employers to re-introduce furloughed workers to their business. You should only re-introduce employees to your business when it makes commercial sense to do so.

It was confirmed today that the furlough scheme will not be extended after October.

VAT rate cut

The VAT rate cut launches next Wednesday (15 July). This rate cut from 20% to 5% on food, hospitality and tourism is welcome. The key to its success for these sectors (apart from making bills slightly cheaper) is a positive reaction from consumers. If you need guidance on the VAT rate cut please contact our tax team now.

Trainees

In a further initiative to boost employment, the Chancellor announced a new trainee scheme for people aged 16-24 which may be of interest to some businesses. The new traineeships will provide classroom-based lessons in maths, English and CV writing, as well as up to 90 hours of unpaid work experience. Employers will be given £1,000 for each new work experience place they offer.

And finally…

There will be a new ‘Eat Out to Help Out’ scheme launched – which offers diners, through the scheme, 50% off their meals out (up to £10 per person) during August. Those hospitality businesses which offer this scheme can claim the lost revenue from the Government.

The Coronavirus Job Retention Scheme will finish at the end of October and there are some important things you need to know as an employer.

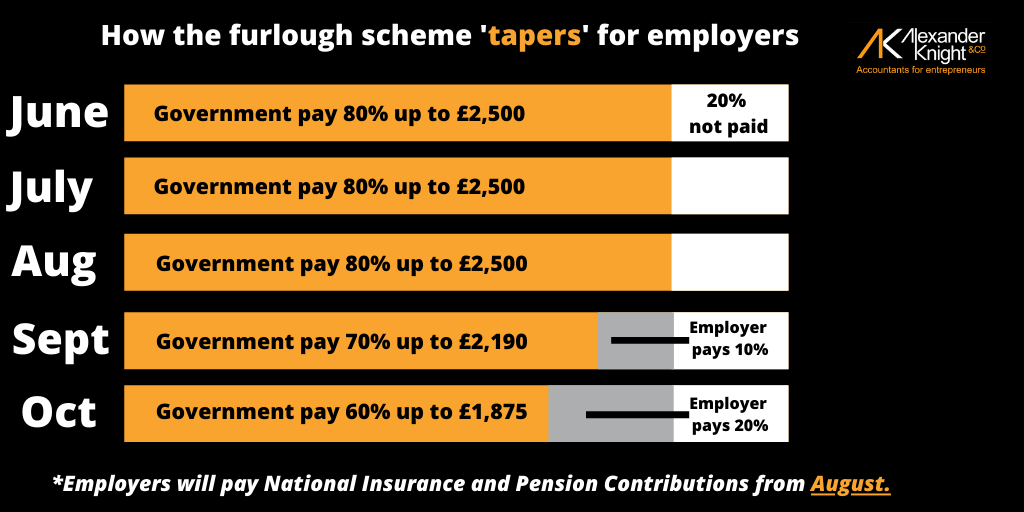

From August, employers must pay National Insurance and pension contributions, then 10% of pay from September, rising to 20% in October.

Furlough scheme changes for employers

Also, employees can return to work part-time from July, but with companies paying 100% of wages.

The scheme was originally intended to last until the end of July and the confirmation that it is running until the end of October is largely good news for employers, employees and the wider economy.

Some businesses, however, may need to consider their staffing levels when the cost of pension contributions and and National Insurance is factored in – as well as the tapering off of the support in September and October.

Support making new furlough claims

It is important that if you are making furlough claims you calculate the amount you can claim accurately. We have already seen multiple instances of clients missing out on money they are entitled to because they have ‘under-claimed‘. Any more additional procedures added to the extended scheme could see more errors being made.

If you are looking for a small business loan (up to a maximum of £50,000) you may wish to consider the ‘bounce-back’ loan scheme launched by the Government.

The scheme is specifically designed to help smaller businesses and may be more appropriate than some of the other ‘loan’ initiatives launched by the Government recently.

What we know so far:

This may be suitable for your business if you require funding up to £50,000.

You can read more about the scheme here.