Furlough scheme: new changes for employers

The Coronavirus Job Retention Scheme will finish at the end of October and there are some important things you need to know as an employer.

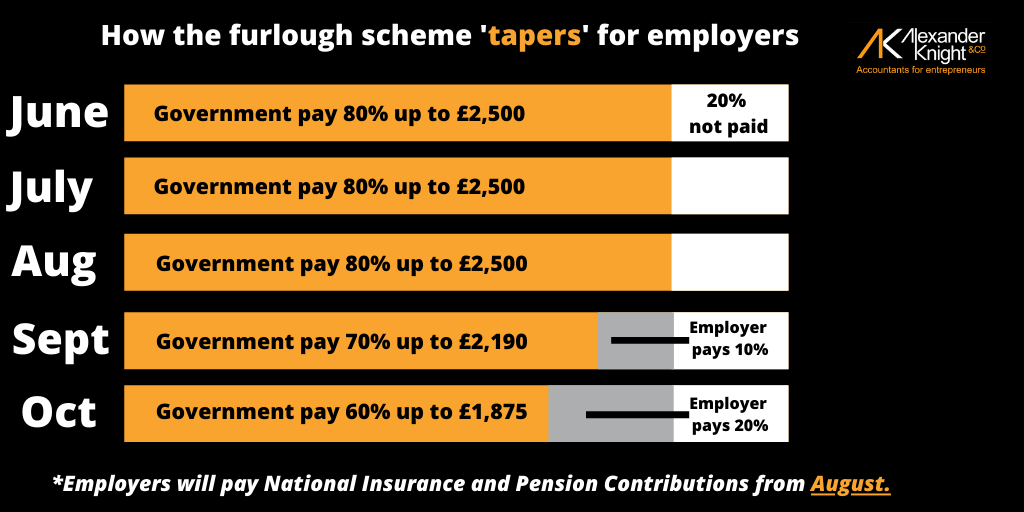

From August, employers must pay National Insurance and pension contributions, then 10% of pay from September, rising to 20% in October.

Furlough scheme changes for employers

Also, employees can return to work part-time from July, but with companies paying 100% of wages.

The scheme was originally intended to last until the end of July and the confirmation that it is running until the end of October is largely good news for employers, employees and the wider economy.

Some businesses, however, may need to consider their staffing levels when the cost of pension contributions and and National Insurance is factored in – as well as the tapering off of the support in September and October.

Support making new furlough claims

It is important that if you are making furlough claims you calculate the amount you can claim accurately. We have already seen multiple instances of clients missing out on money they are entitled to because they have ‘under-claimed‘. Any more additional procedures added to the extended scheme could see more errors being made.