New support measures announced for company directors by the Government.

A series of new measures were announced today by Rishi Sunak, the Chancellor, aimed at providing businesses more support during the ‘long winter’ ahead. We are currently analysing what these new measures mean for all our clients and as more details emerges we will update you on what it means for your business.

More time to repay loans

These measures are helpful to the firms who have managed to trade through the crisis so far but were getting increasingly worried about repaying the fresh debt taken on in the form of Government support.

Entrepreneurs who took out bounceback loans or CBILS will welcome the increasing flexibility of repayments. The ability to reduce the monthly payments by spreading it across a further four years (up from six years) will certainly help the cashflow situation of many SME’s.

Further VAT deferrals

Many SME’s deferred their VAT bill and the opportunity to spread the repayment of this (due in March 2021) throughout next year will be snapped up by many business owners who should be planning to focus on cashflow during the winter months as the furlough scheme dries up.

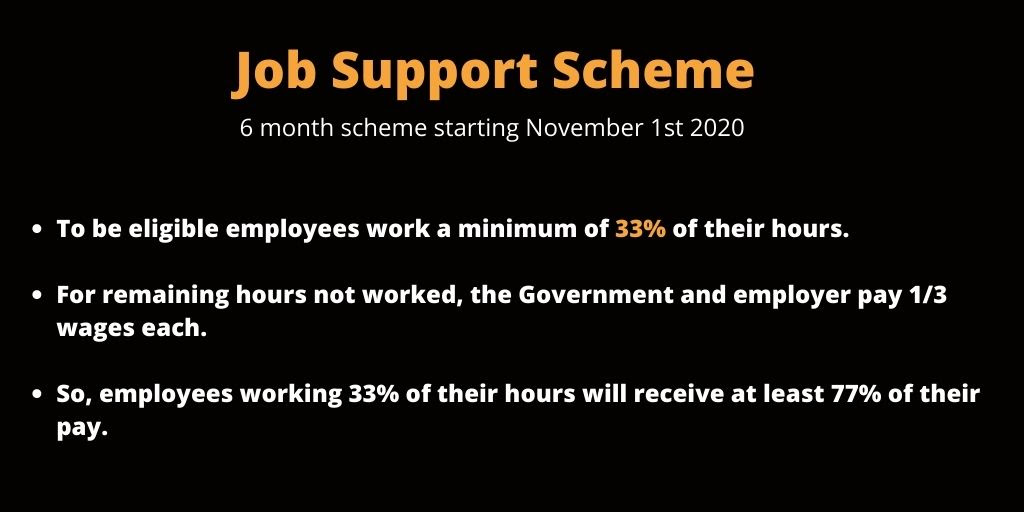

New ‘Job Support Scheme’

Unfortunately, the new Job Support Scheme, which we are dubbing the “little brother of furlough”, is merely marginal support for companies who are still trading. Firms who have not been trading during the past few months will find no solace in this scheme and stand to gain very little. Put simply it looks like this:

It is important that if you are making claims under the new scheme you calculate the amount you can claim accurately. If you need support to make your claim – email Murray Patt now.

And finally…

Around 11 million self-assessment taxpayers will be able to benefit from a separate additional 12-month extension from HMRC on the “Time to Pay” self-service facility, meaning payments deferred from July 2020, and those due in January 2021, will now not need to be paid until January 2022.

We are awaiting further details of this particular scheme to see of this applies to all our clients. |

NEW furlough scheme launched

NEW furlough scheme launched